Surplus Equity Receivables, LLC.

Making a Difference by Reuniting Rightful Owners with Their Recovered Funds.

We're helping to locate and reunite rightful owners and heirs with funds that are owed to them. These individuals are often unaware of existing funds that once belonged to their loved one.

WE'RE HERE TO HELP

At Surplus Equity Receivables, LLC, we are more than just a service platform; we are your trusted company in helping you to recover a dormant account, saving account, life insurance policy, investment journey and more. Our story began with a passion for reunited and connecting owners to their dormant account.

Types Of Funds We Recover

Foreclosure Funds

Unclaimed Funds

Tax Overage Excess Funds

Bankruptcy Funds

Services

We are here to help!!

If you think you have unclaimed funds or would like to find out if you have any unclaimed funds available to you, please fill out this form and we will reach out to you!

Tax Overage Excess Funds

What are Tax Overage Funds?

*Homeowners that fail to pay their property taxes

*These properties will then be auctioned as tax foreclosures by the local county

Foreclosure Funds

Sometimes, a lender may set the starting bid at an auction for the mortgage, plus additional interest. If a home is sold for more than the balance of the mortgage loan, the difference is called surplus funds.

Homeowners are required to pay lenders after a foreclosure if the sale does not cover the mortgage - banks must return surplus funds to owners if the property brings more than the amount still owed on the loan.

You may be entitled to the entire amount of the surplus if you are the previous homeowner.

To recover the surplus funds, you must act within a certain period. If you fail to take action during the time specified by the state, then you will lose the right to the funds.

If no surplus money claims are filed by the homeowner, then other parties, such as the second mortgage holder, tax lien holder, or credit card lienholder, may file the claim.

When a claim for surplus funds is filed, the court will set a hearing to determine who is entitled to the funds. Typically, subordinate lien holders get access to surplus funds first, and then the balance goes toward paying the second mortgage if there is one.

Bankruptcy Funds

What are Bankruptcy Funds?

*Funds that are undelivered due to:

*Incorrect address for the recipient

*Uncashed distribution checks

*Death of the intended recipient

TESTIMONIALS

CUSTOMER REVIEWS

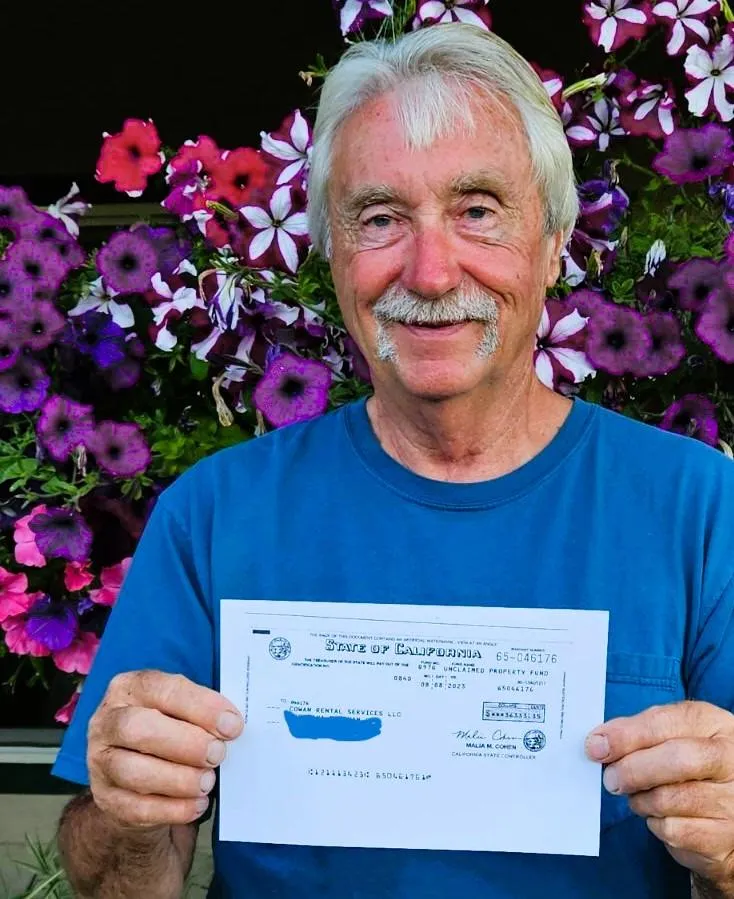

Ray Kerr. In CA

Unclaimed Funds

"Thank you Mrs. Yang for helping me recover my surplus funds. Without your help, I wouldn't even know this fund existed."

-Ray Kerr., California

Jacqueline E. F . in GA

Tax Overage Funds

Jacqueline E. F., Georgia.

Foreclosure Funds

"Thank you Mrs. Yang for your services."

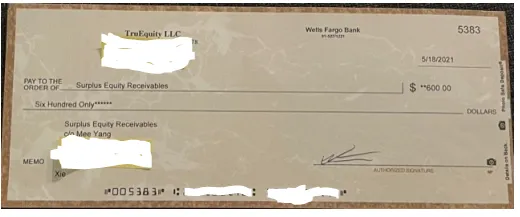

-Jian Qiang Xie, California

Unclaimed Funds

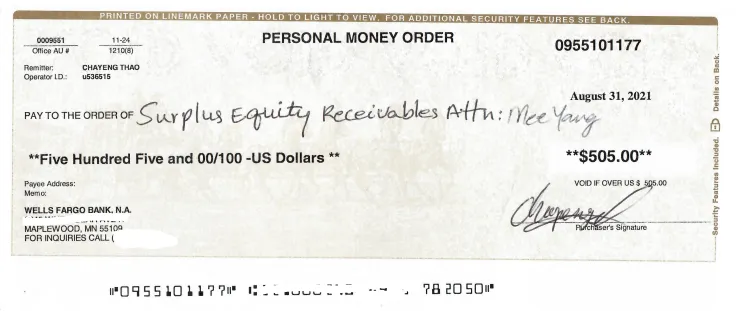

"Thank you for letting me know and helping me recover the funds. At first, I thought it was a scam. All my friends and family said it was a scam, don't do it. But I said at least I'll give it a try and see if it was real. I provided my information to Surplus Equity Receivables, I trusted them to help recover these funds for me. I'm so happy for your help and it's real. I got my check!! Thank you Mee Y."

-Chayeng T.

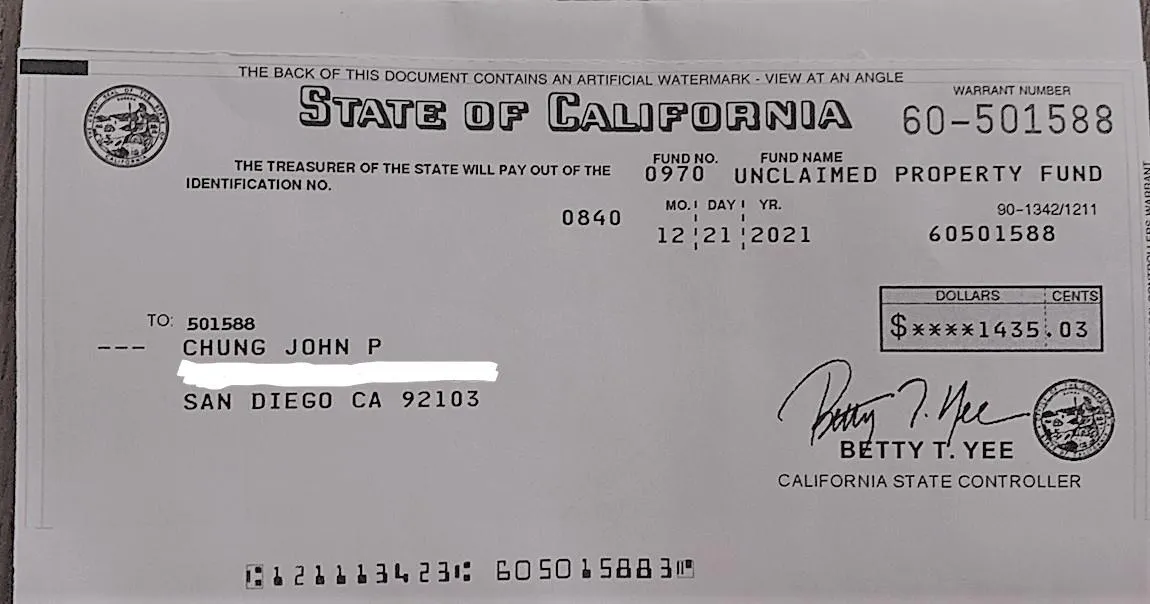

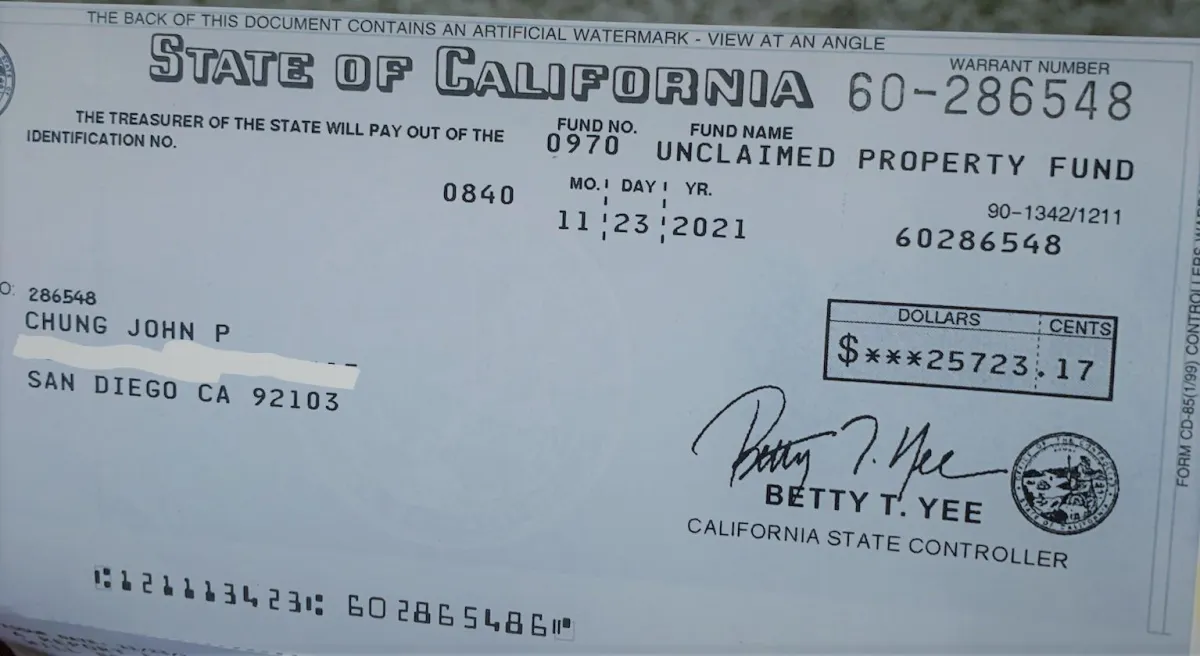

Recovered funds owed to him for over 10 years.

Unclaimed Funds

Life insurance policy estate of John C. and Audrey C., recovered for John C. Junior.

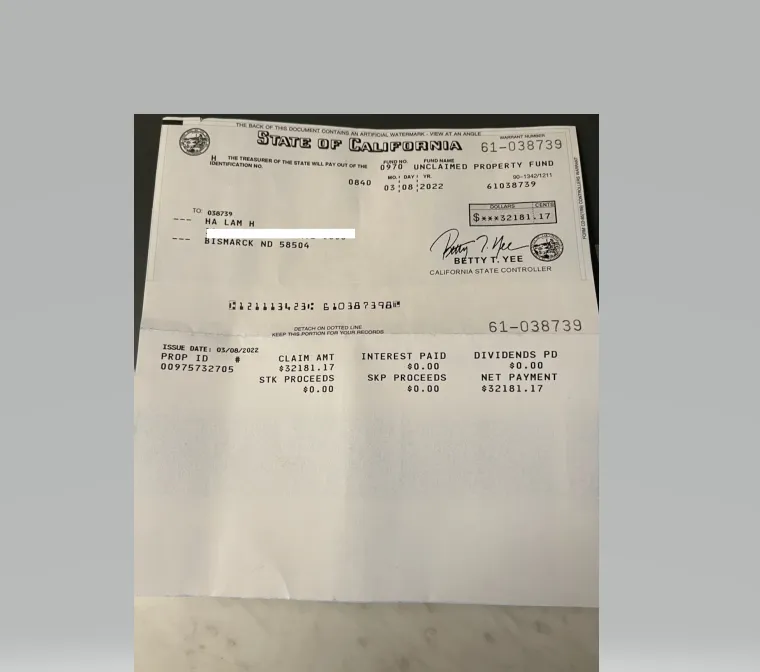

Unclaimed funds

Recovered funds owed to his parents for over 10 yrs ago. Thanh L. & Khanh L.

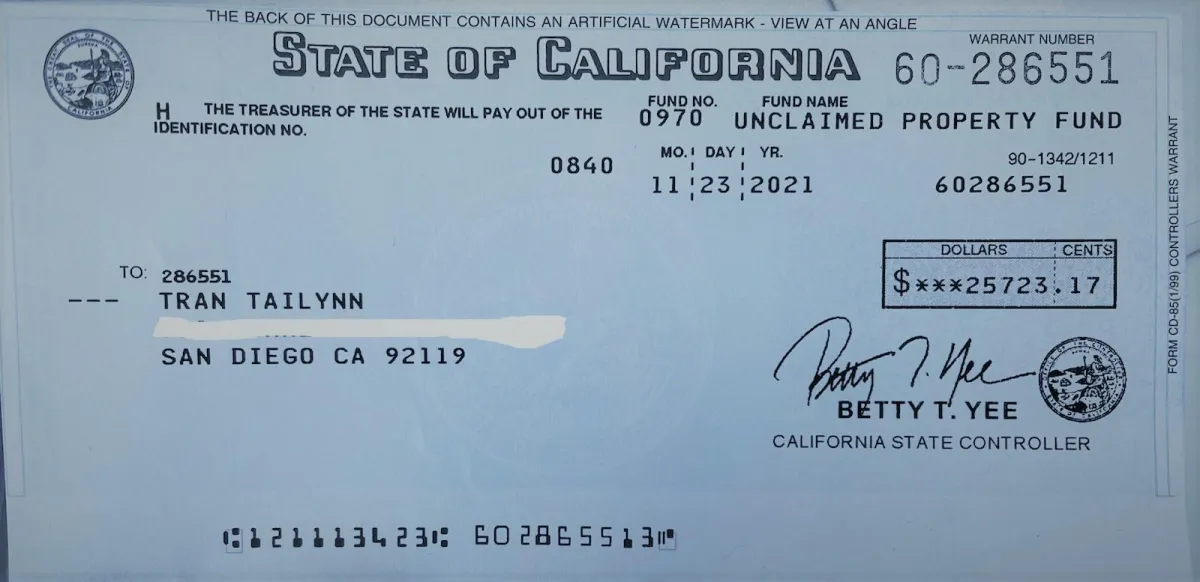

Unclaimed Funds

Life insurance policy owed to her dad and grandmom over 11 years.

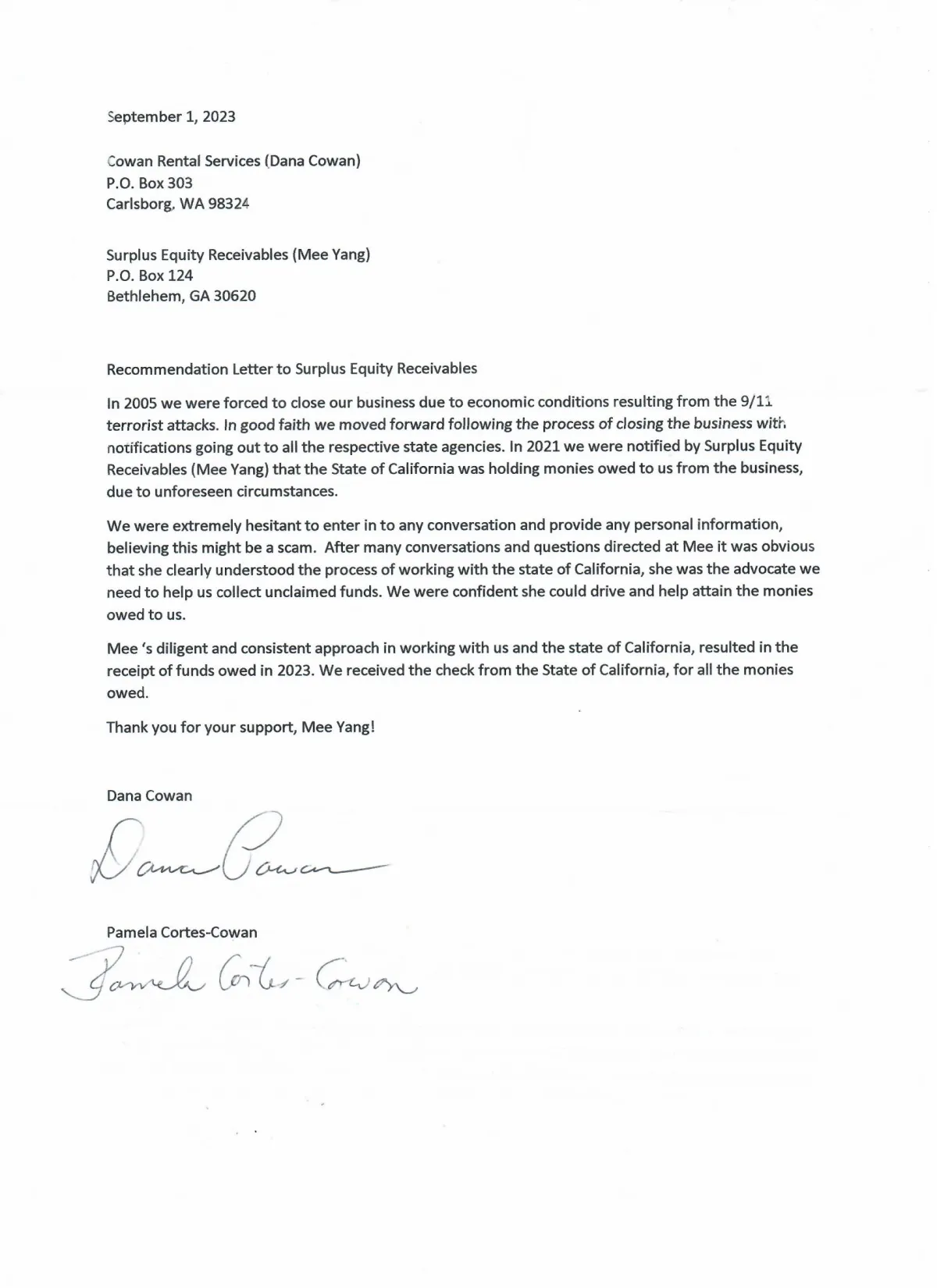

Funds owed to Cowan Rental Services, LLC.

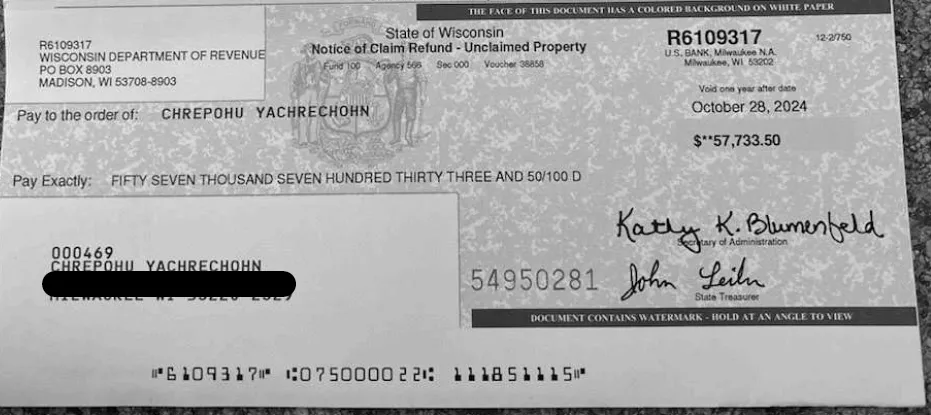

Chrepohu Yachrechohn WI-dormant stock account owed to him.

GA -Recover a dormant Saving Account funds.

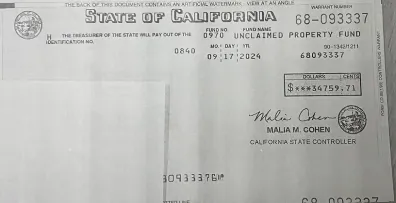

Forclosure funds owed to Nida Cacho in CA

GA-Recover a dormant saving account funds over 7 years

Your Testimonial Will Go Here!!

Hamid in CA - Life Insurance owed to his parents.

Hamid in CA - Life Insurance owed to his parents.

OUR TEAM

Mee Yang

At Surplus Equity Receivables, LLC., our team are passionate professionals with success in helping clients recover funds that were owed to the owner or their loved one.

FAQS

1. What are unclaimed funds?

Unclaimed funds refer to money or financial assets that have been abandoned or forgotten by their rightful owners. These funds can come from a variety of sources, including:

*Bank accounts (savings and checking)

*Uncashed checks

*Insurance policies

*Refunds and overpayments

*Stocks, bonds, and dividends

*Utility deposits

2. How do funds become unclaimed?

Funds become unclaimed when the rightful owner fails to access or claim them within a certain period. This often happens when contact information is outdated, checks are not cashed, or the owner simply forgets about the funds.

[Your Company Name] stands out for several reasons. First, we prioritize transparency and trust in all transactions, ensuring fair and honest dealings for all parties involved. Second, our platform offers exclusive market insights and expert guidance, empowering you to make informed investment decisions. Third, we provide a thriving community of investors where you can network, learn, and grow. Lastly, our team of industry experts is here to support you every step of the way, making your real estate wholesaling journey efficient and successful.

3. What if the original owner of the funds is deceased?

If the rightful owner is deceased, the funds may be claimed by their legal heirs or estate representatives.

Absolutely! Real estate wholesaling can be an excellent entry point for newcomers to real estate investing. We offer comprehensive resources, step-by-step guidance, and a supportive community to help beginners get started with confidence. Our team of experts is available to answer your questions and provide personalized assistance, ensuring that you can navigate the world of real estate wholesaling successfully, regardless of your experience level.

4. How long does it take to receive the funds after filing a claim?

Processing times vary depending on the agency or institution. It can take anywhere from 3 months to 1 years to verify the claim and release the funds.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

7. What happens if I don’t claim my funds?

If unclaimed funds remain unclaimed for an extended period, they may become the property of the state or the issuing institution. However, most states hold these funds indefinitely until they are claimed.Your Title Here

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

8. Are unclaimed funds held by private companies or the government?

Unclaimed funds may be held by state government agencies, banks, insurance companies, or other financial institutions. Most states require companies to transfer unclaimed funds to the state after a certain period.Your Title Here

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Surplus Equity Receivables, LLC.

Term and Codition

Terms and Conditions

Effective Date: February 25, 2025

1. Introduction

Welcome to Surplus Equity Receivables, LLC. ("we," "our," or "us"). By accessing and using our website and services, you agree to comply with and be bound by these Terms and Conditions. If you do not agree with these terms, please do not use our services.

2. Use of Services

You agree to use our services for lawful purposes only. You shall not:

Violate any applicable laws or regulations

Engage in fraudulent or deceptive practices

Interfere with the security or functionality of our services

3. Account Registration

To access certain features, you may need to register an account. You agree to provide accurate and complete information and keep your account credentials secure. We are not responsible for any unauthorized access to your account.

4. Intellectual Property

All content, trademarks, logos, and other materials on our website are the property of Surplus Equity Receivables, LLC. or its licensors. You may not reproduce, distribute, or modify any content without prior written permission.

5. Limitation of Liability

We are not liable for any indirect, incidental, or consequential damages arising from your use of our services. Our total liability, if any, shall not exceed the amount paid by you for our services.

6. Termination

We reserve the right to suspend or terminate your access to our services at our discretion, without notice, if you violate these Terms and Conditions.

7. Governing Law

These Terms and Conditions shall be governed by and construed in accordance with the laws of United State or the State of Geogia. Any disputes arising shall be subject to the exclusive jurisdiction of the courts in United State.

8. Changes to Terms

We may update these Terms and Conditions from time to time. Any changes will be posted on this page with an updated effective date.

9. Contact Us

If you have any questions about these Terms and Conditions, please contact us at Surplus Equity Receivables, LLC. at email address: contact@surplusequityreceivables.com, P.o. box 124 Bethlehem, GA 30656

"By agreeing to receive messages from Surplus Equity Receivables, LLC, you understand that Message frequency varies, and message/data rates may apply.

"You have successfully subscribed to Surplus Equity Receivables, LLC. text updates."

"Welcome to Surplus Equity Receivables, LLC. text alerts! Reply STOP to unsubscribe."

Opt-out Keywords: Please use "Stop" or "Unsubscribe."

Opt-out

"You have successfully unsubscribed from Surplus Equity Receivables, LLC. text updates."

"You will no longer receive text messages from Surplus Equity Receivables, LLC."

Subscriber Help Keyword: Please use "Help."

Subscriber Help Message Examples:

"For assistance, please contact us at 414-251-0094."

"Reply STOP to unsubscribe. Message and data rates may apply."

Reply STOP to opt out."

"Mobile information will not be shared with third parties for marketing purposes. To opt-out, text STOP"

"By submitting this form, you consent to receive marketing messages from Surplus Equity Receivables, LLC. Msg & data rates may apply. Message frequency varies. Unsubscribe by replying STOP. Reply HELP for support. Privacy Policy

I Consent to Receive SMS Notifications, Alerts & Occasional Marketing Communication from company. By submitting this form and signing up for texts, phone call and email. You consent to receive marketing messages (DELIVERY_NOTIFICATION, MARKETING, CUSTOMER_CARE) from Surplus Equity Receivables, LLC. at the number provided, including messages sent by auto-dialer. Consent is not a condition of purchase. Msg & data rates may apply. Msg frequency varies. Unsubscribe at any time by replying STOP or clicking the unsubscribe link (where available). Reply HELP for help. Privacy Policy [link] & Terms of Services[link]Message frequency varies. Message & data rates may apply. Text HELP to 414-251-0094 for assistance. You can reply STOP to unsubscribe at any time.

Privacy Policy

Privacy Policy

Effective Date: 03/11/2025

1. Introduction

Surplus Equity Receivables, LLC. ("we," "our," or "us") values your privacy and is committed to protecting your personal information. This Privacy Policy explains how we collect, use, and safeguard your information when you use our website and services.

2. Information We Collect

We may collect the following personal information from you:

Name

Email Address

Mailing Address

Phone Number

We collect this information when you voluntarily provide it to us through our website, forms, or other interactions.

3. How We Use Your Information

We use the information we collect to:

Provide and improve our services

Communicate with you, including sending updates, promotional materials, and important notices

Process transactions (if applicable)

Comply with legal requirements

4. Sharing Your Information

We do not sell, rent, or trade your personal information. However, we may share your information with third parties under the following circumstances:

With service providers who assist in operating our business (e.g., email marketing platforms, payment processors)

If required by law, legal proceedings, or government authorities

Provided information to the State as they relate to your dormant account

5. Data Security

We take reasonable measures to protect your personal information from unauthorized access, alteration, disclosure, or destruction. However, no data transmission over the internet can be guaranteed as 100% secure.

6. Your Rights and Choices

You have the right to:

Access, update, or delete your personal information

Opt out of marketing communications

Request details about how your data is used

To exercise these rights, please contact us at contact@surplusequityreceivables.com

7. Cookies and Tracking Technologies

We may use cookies and similar tracking technologies to enhance your experience. You can control cookie preferences through your browser settings.

8. Changes to This Privacy Policy

We may update this Privacy Policy from time to time. Any changes will be posted on this page with an updated effective 02/25/2025.

9. Contact Us

If you have any questions about this Privacy Policy, please contact us at: Surplus Equity Receivables, LLC. at email address: contact@surplusequityreceivables.com, P.o. box 124 Bethlehem, GA 30656

"By agreeing to receive messages from Surplus Equity Receivables, LLC, you understand that Message frequency varies, and message/data rates may apply. Reply STOP to opt out."

"By submitting this form, you consent to receive marketing messages from Surplus Equity Receivables, LLC. Msg & data rates may apply. Message frequency varies. Unsubscribe by replying STOP. Reply HELP for support. Privacy Policy